Transitioning from P2P App to Financial Ecosystem

Ambition and Context

Organization

At Venmo, the mandate was to evolve the product beyond peer-to-peer payments into a trusted, everyday financial platform. While new financial products had launched, user awareness and in-app discovery lagged behind the business strategy, resulting in fragmented experiences and underutilized capabilities.

I led cross-functional efforts to align executive stakeholders around a unified platform vision, translating business ambition into a coherent product strategy. This included reshaping the roadmap, establishing discovery and navigation systems, and strengthening platform cohesion so users could understand, adopt, and confidently engage with Venmo’s expanding financial services.

Team

To support Venmo’s transition into a multi-product financial ecosystem, I scaled UX leadership and delivery capacity to match the platform’s growing complexity. I led the evolution of the design system to support new product categories, increased surface area, and long-term scalability without sacrificing quality or speed.

Beyond systems, I strengthened team structure and capability by introducing specialized roles, operationalizing cross-team collaboration, and mentoring emerging design leaders. These changes enabled teams to move from siloed execution to coordinated platform delivery, ensuring consistency across experiences while accelerating adoption of new financial offerings.

Culture

A successful ecosystem shift required tighter alignment between UX, Marketing, and Product. Historically, siloed ownership had slowed execution and weakened the connection between brand promise and product reality.

I led a cultural shift toward shared ownership by embedding co-creation frameworks, collaborative decision-making rituals, and operating norms that aligned teams around a single platform narrative. This approach ensured the new brand identity was not just expressed visually, but reinforced through product behavior, in-app discovery, and end-to-end experience design.

The result was a more cohesive platform presence that strengthened trust, increased engagement, and positioned Venmo as a credible financial ecosystem rather than a single-use product.

Actions

Executive Mandate

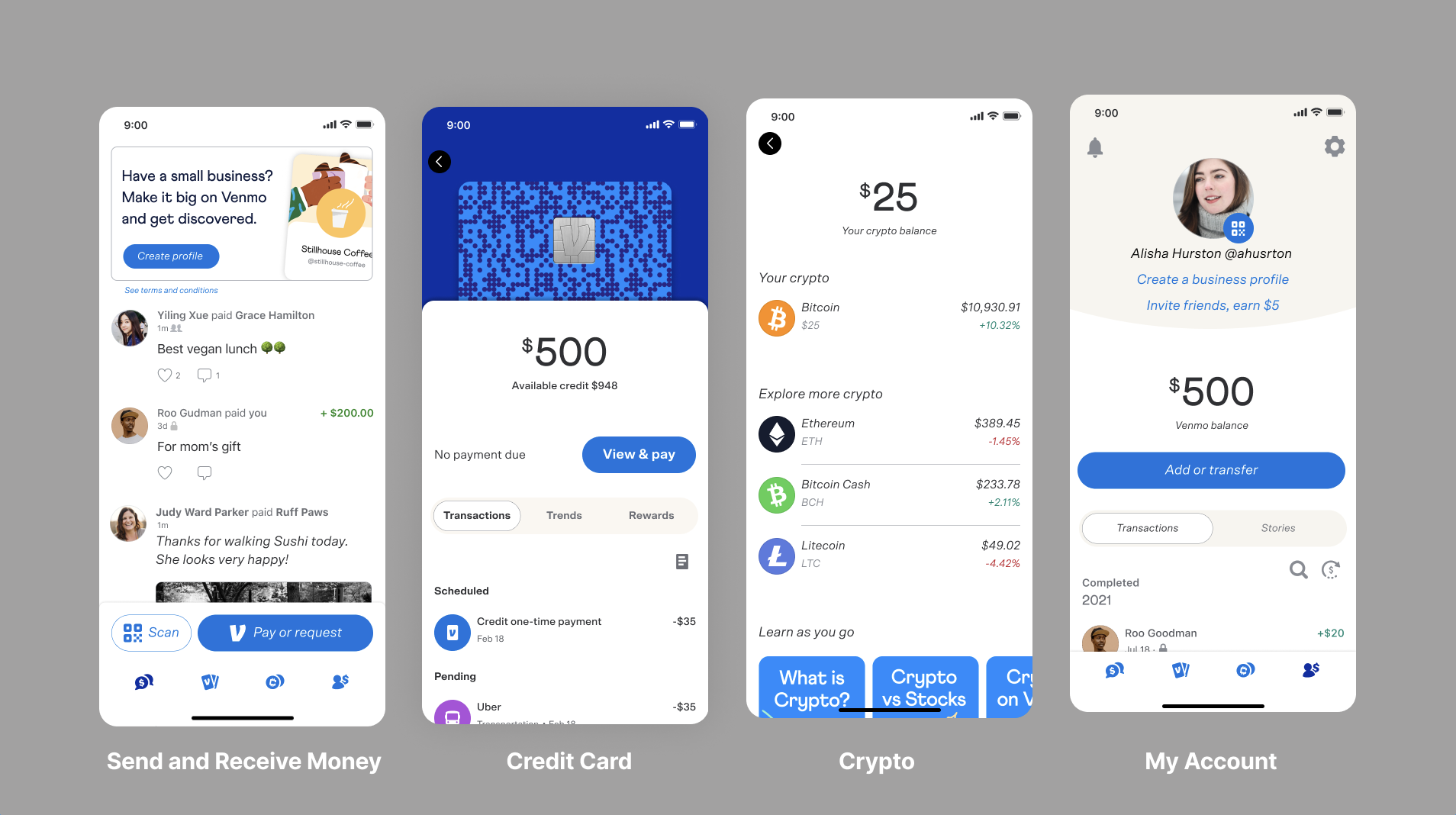

Venmo’s executive mandate was to reposition the product for its next phase of growth by evolving from a peer-to-peer payments app into a trusted, multi-product financial ecosystem. Success depended on increasing adoption of new financial offerings, strengthening brand coherence, and making Venmo’s expanding value legible and credible to users.

What I Changed

I shifted Venmo from feature expansion to platform clarity.

Rather than optimizing individual launches, I reframed the work around ecosystem coherence. Design moved from supporting execution to shaping how users discovered, understood, and trusted Venmo as a financial platform. This meant aligning brand, product, and experience around a shared strategic narrative and elevating design as a driver of adoption and perception.

How I Operationalized It

I built systems that enabled scale without fragmentation:

Established a unified platform vision aligned to Venmo’s evolving financial strategy

Introduced scalable discovery and navigation patterns to surface new products intuitively

Evolved the design system to support multi-product experiences with consistency and speed

Embedded brand strategy directly into product workflows through close UX–Marketing collaboration

Institutionalized insight-driven iteration through testing, learning loops, and behavioral data

-

I led the shift from a transaction-first product to a platform with a clear financial identity. This meant aligning product, brand, and experience around a shared narrative of financial empowerment, not just expanding features. By clarifying how Venmo’s offerings worked together, we made the platform’s growing value visible, trustworthy, and easier to adopt.

-

As Venmo expanded into cards, crypto, and broader financial services, I evolved the design system to support multi-product complexity without sacrificing simplicity. The system enabled faster delivery, consistent interaction patterns, and brand coherence across teams, ensuring new offerings could scale without fragmenting the user experience.

-

I repositioned design as a strategic partner in shaping product direction, not just execution. By connecting experience decisions to business priorities like adoption, engagement, and trust, design became a lever for growth rather than a downstream function. This shift strengthened cross-functional alignment and improved decision quality at the leadership level.

-

I built scalable leadership development systems to elevate craft, strengthen strategic thinking, and embed user-centered excellence across teams. Mentoring senior ICs, developing capability frameworks, and operationalizing feedback and learning rituals enabled teams to consistently deliver exceptional experiences that drive measurable business impact, foster innovation, and sustain organizational growth.

-

I scaled the team’s ability to operate in a more complex product environment by clarifying roles, strengthening collaboration models, and mentoring emerging leaders. The focus was not headcount growth alone, but building durable capacity so teams could deliver high-quality outcomes repeatedly as the platform evolved.

Achievements

Venmo’s platform transformation repositioned the brand as a cohesive financial ecosystem, deepening user engagement, accelerating multi-product discovery, and strengthening the foundation for long-term enterprise growth.

Venmo’s platform transformation repositioned the product from a peer-to-peer payment app into a cohesive financial ecosystem. By improving in-app discoverability, scaling design infrastructure for multi-product growth, and aligning experience decisions with enterprise strategy, the work strengthened adoption, engagement, and long-term platform value.

Measurable Outcomes

Expanded Multi-Product Adoption: Credit and debit card applications increased by 35%, driven by clearer product positioning and more intuitive discovery paths that helped users understand Venmo as a broader financial platform.

Accelerated Crypto Engagement: Improved navigation and contextual education led to a 28% increase in cryptocurrency transactions, expanding Venmo’s presence in the digital asset space while maintaining usability and trust.

Improved Cross-Product Discoverability: Redesigned platform navigation increased interactions with new financial offerings by 40%, reinforcing engagement across products rather than siloed feature use.

Scalable Design Infrastructure: The design system was evolved and operationalized to support rapid expansion into new financial services, enabling consistent experiences, faster delivery, and strong brand cohesion across the ecosystem.

Together, these results reflect a successful shift from feature expansion to platform thinking. The transformation strengthened Venmo’s brand equity, deepened multi-product engagement, and established a scalable foundation for sustained enterprise growth and innovation.

Enduring Impact

Platform-Level Growth Foundation: Established a cohesive ecosystem model that allows new financial products to be introduced without degrading usability, trust, or brand clarity.

Sustained Discoverability and Engagement: Embedded discovery patterns and experience principles that continue to surface new offerings as user needs evolve.

Operational Design Maturity: Institutionalized design systems, cross-functional alignment, and decision frameworks that enable long-term scalability beyond individual product launches.

Strategic Brand Repositioning: Reinforced Venmo’s identity as a financial platform rather than a transactional utility, strengthening brand equity and positioning the company for future expansion.

Together, these outcomes reflect a shift from feature-led growth to platform-led strategy, delivering immediate performance improvements while creating durable organizational and product infrastructure for sustained enterprise growth.